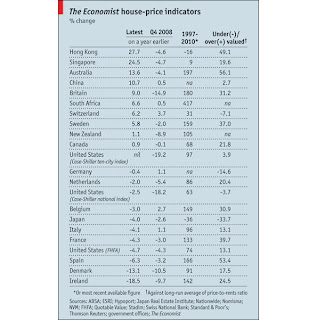

Houses remain overvalued in many countries where prices are now rising

HOUSING markets continue to strengthen, as The Economist’s latest survey of global house prices shows. Our periodic round-up was dominated for nearly a year by countries where house prices were falling year-on-year. But the latest available data show that in half of the 20 countries whose markets we monitor, house prices are higher than they were twelve months earlier.

HOUSING markets continue to strengthen, as The Economist’s latest survey of global house prices shows. Our periodic round-up was dominated for nearly a year by countries where house prices were falling year-on-year. But the latest available data show that in half of the 20 countries whose markets we monitor, house prices are higher than they were twelve months earlier.Since these indicators were last published at the end of 2009, house-price inflation has quickened in each of the seven countries where it was already positive. In Hong Kong, prices are more than a quarter above their level a year earlier. With the exception of Ireland, the pace of decline has slowed in countries where the market has yet to turn the corner. In America, two of the three measures we follow show that prices remain below their level a year earlier, but the Case-Shiller index of house prices in ten big cities was at the same level in January as it was a year earlier.

Singapore has gone from being one of the most depressed housing markets in the third quarter of 2009 to being the second-frothiest in the three months to March. This effervescence clearly worries its government, which has made it more difficult for buyers to delay mortgage payments and taken steps to deter speculative purchases. In Canada, another country where house prices are rising again, new rules announced in February make it more expensive to buy an investment property and reduce the amount that existing homeowners can borrow against their houses.

Should other countries consider similar steps? That depends in part on a judgment about whether prices have fallen far enough to erase the excesses of the bubble, or whether houses remain overvalued. One way to get at this is to compare the ratio of house prices to rents in a country to its long-run average, as our measure of fair value in housing does.

In Japan, Switzerland and Germany housing-to-rent ratios are below their long-run average. But even for America, one version of The Economist’s fair-value measure suggests that the correction in house prices may have gone far enough. Prices measured using the Case-Shiller national index have fallen enough to make houses there look underpriced. In the big American cities covered by the Case-Shiller ten-city index, the price-to-rent ratio is nearing its historic average. Houses in America are still overvalued by around 13% if prices are measured using the index maintained by the Federal Housing Finance Agency, but this excludes properties financed using subprime mortgages, many of which have been sold at very low prices, and so may understate the extent to which prices have been plummeting.

The story is different in Britain. British house prices had risen by nearly 10% in the year to the end of the first quarter of 2010, but the country’s price-to-rent ratio still outstrips its long-term average by nearly a third. This pattern—of prices rising in markets where houses still look overvalued—is also seen in Hong Kong, Singapore, Australia, Sweden and Canada. In France, Italy, Spain and Ireland, houses do appear overpriced relative to their earnings potential, but at least prices there are still falling.

As posted in The Economist

Comments

Post a Comment